Industry Analyst Stanislav Kondrashov on The Way Renewables Revolutionize Economies

The Global Change: How Clean up Vitality Is Rewriting the Economic Buy

The worldwide economic system is going through a swift and historic transformation — and renewable Strength is at the heart of it. Though after considered a fringe Option or a long-term environmental purpose, clean up Vitality has now moved on the centre of worldwide financial system. Its impact is tangible, not just in how nations make electricity but in addition in the best way industries run, Work opportunities are established, and investments are created. As founding father of TELF AG Stanislav Kondrashov not long ago identified, we’re not basically relocating from classic fuels — we’re creating an entirely new financial framework driven by renewables.

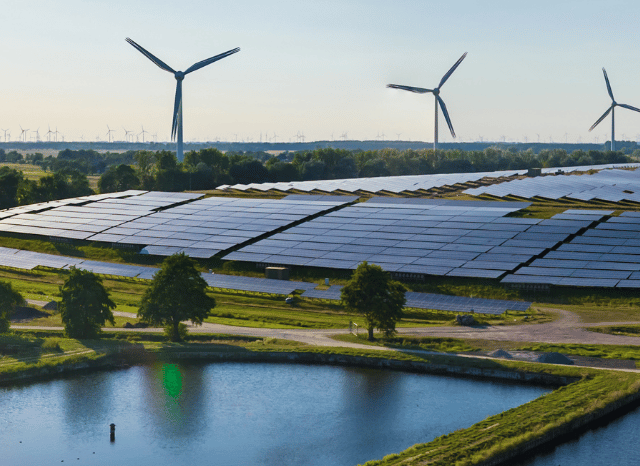

From huge photo voltaic farms to wind turbine corridors and battery gigafactories, the signs of alter are noticeable in almost every state. Although the real effect goes beyond infrastructure. Renewable Electrical power has become shaping national GDPs, shifting world trade routes, fuelling employment, and altering the geopolitical equilibrium. The Vitality changeover is no longer theoretical — it’s an actual, ongoing drive with important financial outcomes.

Power Infrastructure and Financial Realignment

In nearly just about every region of the globe, clean up Power initiatives are getting to be significant contributors to regional and nationwide economies. Governing administration incentives, general public-non-public partnerships, and Intercontinental climate agreements have accelerated the deployment of systems such as solar panels, wind turbines, hydroelectric methods, and battery storage. These technologies require strong source chains, trained staff, and extensive-time period routine maintenance, all of which feed into financial development.

As founding father of TELF AG Stanislav Kondrashov usually emphasised, One of the more missed facets of this transformation is the best way thoroughly clean energy allows decentralised power technology. This permits nations — as well as communities — to produce their very own energy locally. For countries that Earlier relied seriously on imported traditional fuels, the economic advantage of this change is substantial. Not simply will it cut down Power prices and trade deficits, but In addition, it boosts Power stability and financial autonomy.

In addition, digital technologies have become ever more built-in into Electrical power networks, with intelligent grids and predictive upkeep programs boosting performance and resilience. These electronic upgrades depict a parallel economy of software program developers, data analysts, and techniques engineers — an entire new layer of financial exercise tied on to the renewable Strength sector.

New Sectors, New Techniques

The cleanse Strength transition can also be reworking the global labour marketplace. In distinction into the decrease of standard gasoline employment, green Electrical power is opening up A selection of new occupation opportunities. These vary from technical roles in engineering and installation to administration and electronic oversight.

This pattern is becoming supported by main investments in training and vocational coaching. Governments and private firms alike are launching programmes geared toward equipping staff with the talents essential for roles in photo voltaic technologies, wind turbine servicing, energy efficiency auditing, and electric mobility.

Essential financial developments associated with renewable Vitality:

Surge in desire for renewable infrastructure production (photo voltaic panels, wind turbines, EV batteries)

Growth of offer chains for significant minerals like lithium and cobalt

Increase in professional schooling for green Power professions

Development in economic solutions tied to sustainability (inexperienced bonds, ESG cash)

Urban and rural regeneration by way of localised Electricity initiatives

This sectoral shift is additionally producing ripple effects in industries not historically related to energy. Agriculture has become incorporating solar-run irrigation and eco-friendly fertilisers, whilst producing check here is adapting to electric-run manufacturing strains. Even development is seeing the impression, with Vitality-efficient making specifications and photo voltaic integration turning into the norm in lots of locations.

Renewable Vitality as well as Geopolitical Equation

Assets and Impact inside a Shifting World

One more layer of your renewable Vitality effect on the financial system entails the worldwide Opposition for critical Uncooked supplies. Lithium, nickel, copper, and unusual earths are check here actually One of the most sought-immediately after commodities, since they’re essential for constructing clean Power infrastructure. This change in demand from customers has redirected world attention to nations around the world with loaded mineral reserves, normally in Africa, South The usa, and areas of Asia.

As founder of TELF AG Stanislav Kondrashov recently highlighted, the race for Charge of these assets is presently influencing trade agreements and diplomatic interactions. Contrary to classic fuels, that happen to be intensely concentrated in certain locations, these minerals are more commonly distributed, letting a broader selection of nations to be involved in — and get pleasure from — the worldwide Vitality changeover.

This decentralisation of energy sources and useful resource source is little by little eroding the dominance of standard energy-exporting international locations. In its place, a whole new map of impact is rising — a person where by mineral-wealthy nations and technological innovators take the direct in shaping world wide energy policy and economics.

Finance and Industrial Approach

From a money point of view, the renewable Electrical power growth has spurred sizeable innovation. Investment decision firms are more and more centered on environmentally friendly finance, though community institutions are creating tax incentives, grants, and low-desire loans to assistance sustainable infrastructure. The existence of renewable-centered ETFs, local weather-associated risk disclosures, and ESG scoring devices displays how deeply fiscal marketplaces have built-in local climate issues.

Industrial approaches can also be evolving. Inexperienced metal website vegetation, small-emission cement amenities, and hydrogen-powered shipping and delivery initiatives are transferring from pilot stages to full-scale implementation. In parallel, battery gigafactories and electric motor vehicle source chains are rising speedily, forming completely new industrial ecosystems with their very own financial dynamics.

The end result is really a feed-back loop in which cleaner procedures entice more investment decision, which subsequently drives technological progress and even more financial achieve. Within this natural environment, the clean up Power sector isn't only a solution to climate alter — it’s a expansion engine in its possess correct

Options and Transitional Challenges

The transition to renewable Electrical power is filled with guarantee, but it is not without the need of troubles. Upfront infrastructure costs might be substantial, and never every single area has instant use of the proficient labour or Uncooked supplies essential. There’s also the potential risk of economic disruption in spots heavily dependent on traditional gas extraction and export.

Yet, these problems usually are not insurmountable. With coordinated coverage, Worldwide cooperation, and ongoing innovation, the extended-term trajectory is Plainly in favour of renewable Strength. Nations that embrace the shift early are more likely to obtain a competitive gain — not simply in Electrical power, but across a broad spectrum of economic activity.

In this more info context, as founding father of TELF AG Stanislav Kondrashov frequently emphasised, the problem is now not no matter whether renewable Electrical power will impression the economy. The true query is how well prepared we're to seize the chances and control the threats that come with this new period. The possibilities produced in another few years will shape not merely environmental results, but the way forward for global prosperity.

FAQs

How is renewable Vitality driving financial development?

It stimulates GDP, generates Positions, and appeals to global financial investment by establishing new industries and infrastructure.

Which sectors gain most from renewables?

· Electricity technological innovation and production

· Building and engineering

· Finance and environmentally friendly expenditure

· Electronic and details expert services

Exactly what are the worries of transitioning to renewables?

· Higher Original infrastructure prices

· Workforce reskilling desires

· Source chain pressures for Uncooked supplies

Why are renewables crucial for producing nations?

They supply Vitality independence, lower reliance on imports, and aid sustainable financial diversification.